Information about carbon accounting and carbon projects is everywhere right now. But finding the right information for your business can be challenging.

Whether it’s through designing and delivering Meat and Livestock Australia’s Carbon EDGE training package, working with Greenham to develop their Beef Sustainability Standard, conducting a baseline assessment of the South Australian grain industry or working with producers across southern Australia to understand and build soil carbon, our sustainability consultants have been supporting the ag sector to understand the carbon space for 20 years.

Recently we asked our Pinion Advisory colleagues what the most common questions are that they’re being asked by their farming clients. We got some great questions! In this article we’re going to answer a few of them and provide some links about where to go for more information.

What can I gain from understanding my farm emissions?

Knowing your “number” is a really powerful and proactive approach to farm management. You are not obliged to share this information with anyone, but it can be used with investors or markets if you choose to do so. Your emissions profile helps to highlight where you should be focusing your effort to improve efficiency and reduce emissions. For example, we know that on most beef farms, enteric methane production makes up about 85% of the total greenhouse gases emitted, so implementing best practices around early turn off rates, removing unproductive breeding stock from the herd and improving genetic stock to reduce emissions can make a big difference. Putting processes in place now to collect the right farm level data will make things easier if carbon accounting becomes mandatory for market access.

When will climate reporting and carbon accounting be mandatory?

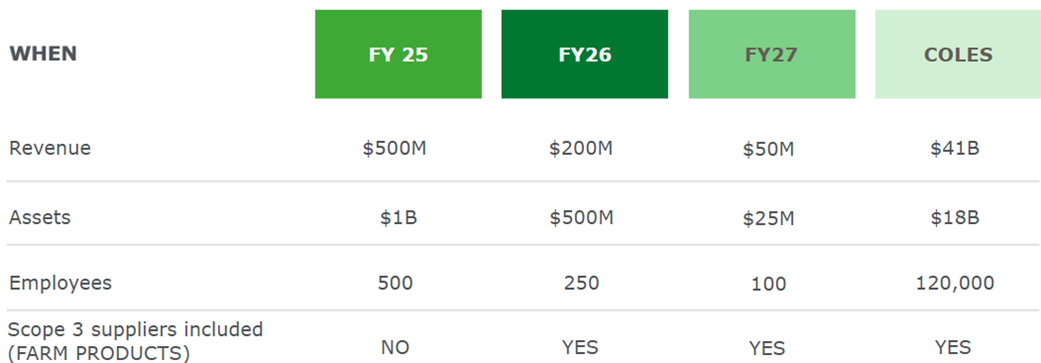

In Australia, climate reporting is already mandatory for large organisations, and this will continue to be phased in, with smaller companies being obliged to report over the coming years if they meet two out of the three criteria below. We have included some data from the Coles annual report as an example of the types of businesses which are now mandated to report on their climate related impacts and dependencies.

Although scope 3 emissions – emissions generated on farms - will be included from 2026, individual farms will not be required to provide their own data in the first few years. Industry averages, spend-based estimates and National Greenhouse and Energy Reporting (NGER) scheme data will likely be used for scope 3 estimates initially. However, it is expected that there will be pressure for continuous improvements in the accuracy of scope 3 data as time goes on. This means that there could come time when your markets are asking for this data.

The banks seem very interested…why is that?

Through zero net emissions targets, mandatory climate reporting and adoption of recommendations from the Taskforce on Nature-related Financial Disclosures (TNFD) banks are under increasing pressure to demonstrate their positive impact on supply chains. They are now offering better finance terms to sustainable producers. As of Sept 2024, agricultural lending hit a record $131B. Lenders are incentivised to reduce their own scope 3 emissions by supporting low-emissions farms.

What are the most common carbon accounting methods?

Right now, there are many calculators that can be used to calculate emissions. The greenhouse gas accounting framework (GAF) and the environmental accounting platform (EAP) are the two most commonly used calculators in agriculture. Keeping track of your data relating to fuel and power use, inputs such as fertiliser type and amount (this one is often challenging but really important for grain calculations), crop yield, stock numbers, sales and movement will set you up for success when it comes to using the calculators. If you want support calculating your number, upskilling or setting up your data collection systems, Pinion can tailor a project to your needs.

To find out more, please get in touch with our sustainability team via Sarah Barrett sbarrett@pinionadvisory.com